Take Control of Your Insurance Renewals

- Argos Connected

- Sep 12, 2025

- 3 min read

Insurance renewal shouldn’t feel like a surprise bill. But too often, fleet managers are left wondering why premiums have jumped, and what they could’ve done to change the outcome.

The good news is that you don’t have to just accept the outcome. If your fleet is already using telematics, you are in a much stronger position than you might realize when it comes time to negotiate your next policy.

At Argos, we work with fleets every day that are taking a more proactive role in conversations with their insurance providers. Instead of being passive participants in the renewal process, they’re leveraging tools like Geotab and Xtract.

The result: confidence, supported by clear, compelling data that highlights their fleet’s commitment to safety, accountability, and effective risk management.

Simplify Claims and Insurance Renewals

Claims are one of the biggest drivers of insurance costs, but the real issue often isn’t just the incident itself. It’s the delays, unclear details, and lengthy investigations that follow.

That’s where incident reconstruction tools like Xtract make a difference. Paired with Geotab and dash cameras, Xtract can recreate an incident in seconds, showing speed, impact force, driver behavior, and road conditions.

And the benefits are clear:

Up to 60% reduction in incident reporting time, turning days into minutes.

25% increase in operational efficiency, streamlining productivity across the board.

Up to 25% more successful dispute resolutions, improving claim outcomes and reducing legal costs.

By reducing claim friction, you not only save time and money, you also show insurers you’re a cooperative, low-risk client worth keeping.

Reshape Your Risk Profile

Insurers don’t just look at past claims when assessing your fleet. They want to know the likelihood and potential severity of future claims and what safety measures you have in place.

That’s where telematics comes in. Instead of being judged only on historical losses or broad industry averages, you can share real-time data that shows how your fleet actually operates.

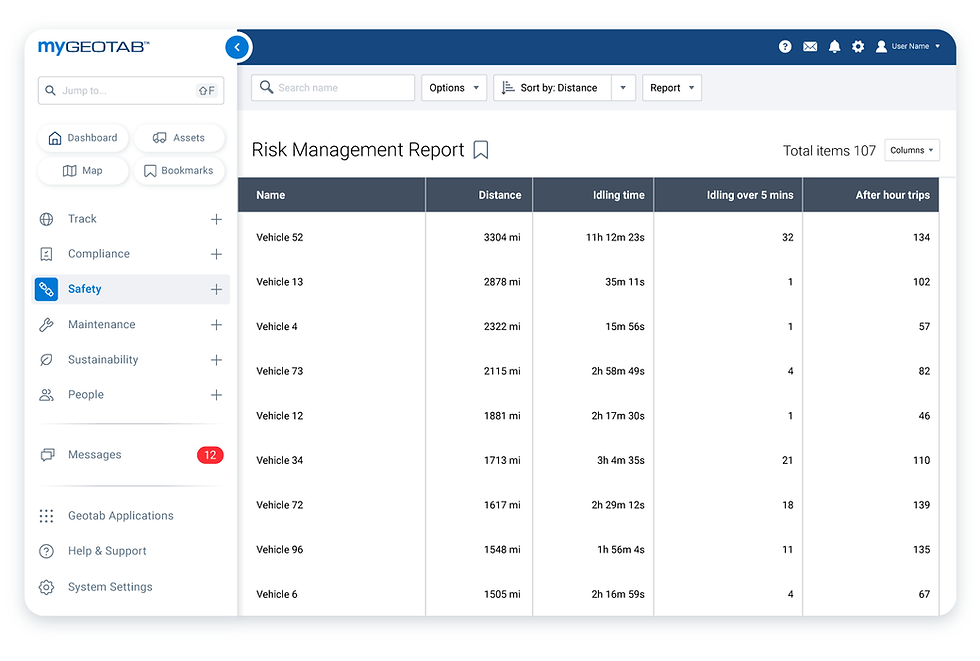

Risk profiles include factors like speeding, harsh braking, cornering, distracted driving, and maintenance compliance. Demonstrating fewer risky behaviors over time or showing how your fleet stacks up against others can make a strong case to insurers.

Use Telematics to Tell Your Story

If you’re already using telematics, make sure the data isn’t being underused. Your team should know how to access key reports, spot trends, and connect insights to safety and performance goals.

Telematics platforms like Geotab collect millions of data points each day, giving a clear picture of driver behavior and vehicle performance. Managers already use this data to improve safety and cut costs, but it can be just as powerful during insurance renewals.

Fleets have used telematics to challenge rate hikes, qualify for usage-based programs, and negotiate lower deductibles. Underwriters aren’t just pricing policies, they’re making judgment calls. Showing that your fleet actively manages risk and invests in safety tech

positions you as a lower-risk client, which can lower premiums.

Ready to Change the Conversation?

Insurance renewals don’t have to feel like a gamble. When you start using your telematics data as a strategic asset, you put yourself in the driver’s seat. You stop relying on assumptions and averages and start telling your fleet’s real story with clarity and confidence.

In our upcoming webinar with the team at Xtract, we’ll show you how fleets are using their telematics data to:

Strengthen their insurance conversations

Speed up claims with incident reconstruction

And challenge costs that just don’t add up

Join us on September 16 at 1 PM EST to learn how to use your data as leverage, not just internally, but at the negotiation table.

.png)

Comments